Vasily Yankov, IOEC Vice President, Founder of Yankov & Partners LLC

ERA OF DIGITAL GIANTS

E-COMMERCE: ORIGINS AND EVOLUTION

The history of Russian e-commerce dates back to the late 1990s, starting with Ozon as an online bookstore, followed by Wildberries in 2004, which emerged as a virtual boutique and absorbed a number of smaller marketplaces (MPs). But it was in the early 2010s that a true revolution in Russian e-commerce began, when both platforms became MPs open to third-party sellers. Over time, this model became dominant, as platforms actively simplified business entry by offering appealing conditions and support, drastically increasing the range of products available.

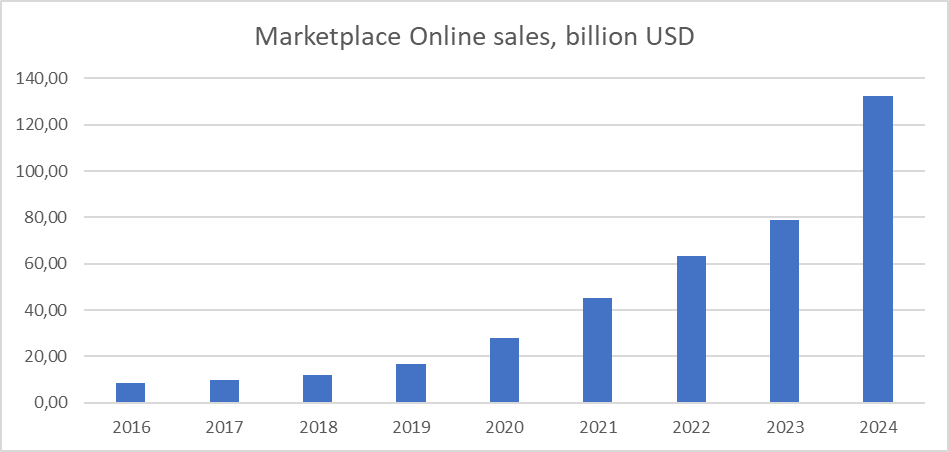

Since then, the market has surged: between 2020 and 2025, the volume of all online sales in Russia has nearly tripled—from about ₽3 trillion to ₽11.3 trillion (+37 %), with more than half of this volume generated by MPs. This was augmented by sanctions, the withdrawal of Western brands, and other trade restrictions which had created a shortage of goods.

The number of MPs and their user base grew exponentially, driven by the growth of the Internet, the development of payment systems and logistics infrastructure.

The history of Russian e-commerce dates back to the late 1990s, starting with Ozon as an online bookstore, followed by Wildberries in 2004, which emerged as a virtual boutique and absorbed a number of smaller marketplaces (MPs). But it was in the early 2010s that a true revolution in Russian e-commerce began, when both platforms became MPs open to third-party sellers. Over time, this model became dominant, as platforms actively simplified business entry by offering appealing conditions and support, drastically increasing the range of products available.

Since then, the market has surged: between 2020 and 2025, the volume of all online sales in Russia has nearly tripled—from about ₽3 trillion to ₽11.3 trillion (+37 %), with more than half of this volume generated by MPs. This was augmented by sanctions, the withdrawal of Western brands, and other trade restrictions which had created a shortage of goods.

The number of MPs and their user base grew exponentially, driven by the growth of the Internet, the development of payment systems and logistics infrastructure.

At a time when the geopolitical landscape is shifting the Russian e-commerce market is demonstrating remarkable resilience, with marketplaces (MPs) serving as its key driver by adapting significant changes in logistics, import structures, and development strategies to meet the needs. This article provides an overview of the key aspects of Russian MPs operations in the context of international cooperation.

LOGISTICS ECOSYSTEM: FORMULA OF SUCCESS

The vast majority of large Russian MPs, regardless of the model, have focused on creating their own logistics infrastructure on a truly huge scale, comprising distribution and sorting centres, pickup points, lockers, mini-warehouses or dark stores for ultra-fast delivery within cities, along with the infrastructure necessary to develop delivery services. These have become their primary competitive advantage and a key driver of accessibility and speed for customers across the vast country. Now let us take a closer look.

Distribution Centres. The number and size of massive hub warehouses ranging from 50,000 to over 500,000 m2 are continually on the rise. Strategically located in Moscow and Leningrad regions, Tatarstan, the Urals, and Siberia, these centres cover the entire country. Here, goods from both third-party sellers and the hybrid MPs own stock are received, stored, and prepared for dispatch.

Sorting Centres. The web of these key transit hubs is spreading in sync with the increasing volumes of goods, ensuring efficient sorting from distribution centres to delivery destinations.

Pickup Points and Lockers. The total number of points across Russia has reached tens of thousands and continues to grow, making it possible to collect orders even in smaller towns. This network, often implemented through franchising, grew thanks to substantial investments across the sector.

The vast majority of large Russian MPs, regardless of the model, have focused on creating their own logistics infrastructure on a truly huge scale, comprising distribution and sorting centres, pickup points, lockers, mini-warehouses or dark stores for ultra-fast delivery within cities, along with the infrastructure necessary to develop delivery services. These have become their primary competitive advantage and a key driver of accessibility and speed for customers across the vast country. Now let us take a closer look.

Distribution Centres. The number and size of massive hub warehouses ranging from 50,000 to over 500,000 m2 are continually on the rise. Strategically located in Moscow and Leningrad regions, Tatarstan, the Urals, and Siberia, these centres cover the entire country. Here, goods from both third-party sellers and the hybrid MPs own stock are received, stored, and prepared for dispatch.

Sorting Centres. The web of these key transit hubs is spreading in sync with the increasing volumes of goods, ensuring efficient sorting from distribution centres to delivery destinations.

Pickup Points and Lockers. The total number of points across Russia has reached tens of thousands and continues to grow, making it possible to collect orders even in smaller towns. This network, often implemented through franchising, grew thanks to substantial investments across the sector.

Mini-Warehouses or Dark Stores. In 2023–2024, investments in the network of small warehouses ranging from 500 to 2,000 m2 in densely populated parts of big cities like Moscow and St. Petersburg intensified. This surge came as a response by leading hybrid MPs to the growing demand for ultra-fast delivery (within 15–30 minutes) of groceries and everyday essentials.

Delivery Services. Leading MPs are expanding their own fleets and developing air transport, particularly for interregional shipments, while complementing these efforts with partner services (Russian Post, CDEK) to reduce delivery time and improve reliability nationwide.

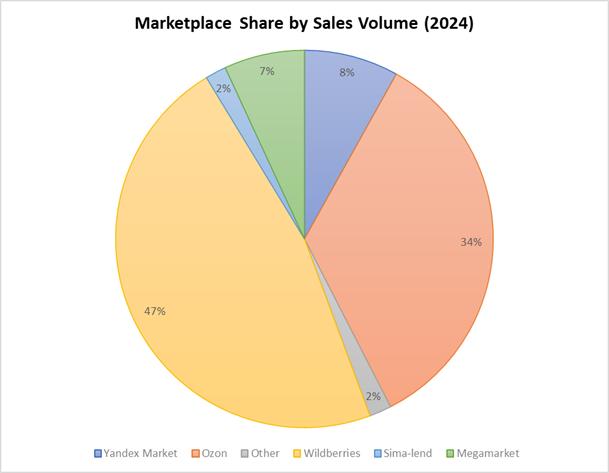

As of the first half of 2024, the distribution of the Russian MP sector by sales volume (GMV) demonstrates ongoing dynamic competition.

INFRASTRUCTURE: LOGISTICS PICKS UP SPEED

Investments in warehouse and transport networks have become a key competitive advantage and a growth driver for the entire sector. In 2025, their total area increased by 65 % to 8.5 million m2, which is twelve times higher than in 2019. Of this, 9.8 million m2 is taken by the MPs themselves, reflecting a 58 % increase over the year.

From January to September 2024 alone, over 1.5 million m2 of new warehouse spaces were created, including central distribution centres, sorting hubs, tens of thousands of pickup points, and dozens of dark stores, with 60 % located in the regions. The Moscow region continues to lead in total area, accounting for over 50 %, followed by St. Petersburg at 11 %, while the remaining space is distributed across other regions.

IMPORTS VIA RUSSIAN MPS

The shifting geopolitical landscape has drastically restructured the supply chains, prompting Russian MPs to

collectively establish imports from new sources. In 2024, the key suppliers were:

There is a steady increase in imports from “friendly” nations, compensating for shifts in traditional supply

chains. The main categories of goods include clothing and footwear, electronics, houseware, and auto parts.

Delivery Services. Leading MPs are expanding their own fleets and developing air transport, particularly for interregional shipments, while complementing these efforts with partner services (Russian Post, CDEK) to reduce delivery time and improve reliability nationwide.

As of the first half of 2024, the distribution of the Russian MP sector by sales volume (GMV) demonstrates ongoing dynamic competition.

INFRASTRUCTURE: LOGISTICS PICKS UP SPEED

Investments in warehouse and transport networks have become a key competitive advantage and a growth driver for the entire sector. In 2025, their total area increased by 65 % to 8.5 million m2, which is twelve times higher than in 2019. Of this, 9.8 million m2 is taken by the MPs themselves, reflecting a 58 % increase over the year.

From January to September 2024 alone, over 1.5 million m2 of new warehouse spaces were created, including central distribution centres, sorting hubs, tens of thousands of pickup points, and dozens of dark stores, with 60 % located in the regions. The Moscow region continues to lead in total area, accounting for over 50 %, followed by St. Petersburg at 11 %, while the remaining space is distributed across other regions.

IMPORTS VIA RUSSIAN MPS

The shifting geopolitical landscape has drastically restructured the supply chains, prompting Russian MPs to

collectively establish imports from new sources. In 2024, the key suppliers were:

- China as the largest partner in terms of volume and range of products.

- Türkiye demonstrated the most impressive supply growth, particularly in clothing, footwear, textiles, food, and furniture.

- EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia) are important partners, particularly for food supplies and as hubs for goods flows.

- Asia (India, Vietnam, Thailand) and the Middle East (UAE, Iran) have seen a noticeable increase in their share of imports through MPs, particularly in electronics, clothing, spices, and fruits.

There is a steady increase in imports from “friendly” nations, compensating for shifts in traditional supply

chains. The main categories of goods include clothing and footwear, electronics, houseware, and auto parts.

PROSPECTS FOR INTERNATIONAL EXPANSION AND DOMESTIC GROWTH

The future of Russian MPs is dynamic and multifaceted, with clearly defined development trends.

Looking beyond the home market, leading Russian MPs are actively expanding their overseas operations,

covering CIS countries (Armenia, Kazakhstan, Belarus, Kyrgyzstan, and others), several Asian nations (China,

Türkiye), the Middle East (Israel, UAE), and Europe (Serbia, Slovakia, Germany, among others), while the

share of international sales in the total GMV of Russian MPs continues to grow.

As for domestic priorities, the following growth areas may be listed:

B2B, as many MPs have launched or are actively developing services for business customers. Striving for better quality, with the industry intensifying its fight against counterfeit and substandard goods by tightening regulations

and implementing moderation technologies.

Technological innovations, namely incorporating AI for personalisation, augmented and virtual reality

technologies, and advancing social commerce. Sustainability, with industry initiatives focused on using sustainable

packaging and optimising logistics.

Regulatory environment is expected to evolve further, with the emergence of a comprehensive framework supervising MPs.

A NEW ERA OF E-COMMERCE

As Russian MPs are living through their peak, with infrastructure developing vigorously and market shares strengthening, Wildberries and Ozon have secured nearly 57 % of all online retail and 81 % of e-commerce orders. Their logistics have caught up with international standards, and plans for international exports and large-scale expansion of warehouse networks suggest that we are entering a new era of global e-commerce.

Audacious plans to expand into foreign markets within the EAEU, particularly by Wildberries and Ozon,

are transforming these MPs from local players into prominent contenders in e-commerce. The future of Russian

MPs lies in further technological advancements, enhanced logistics, and the success of global strategies.

The future of Russian MPs is dynamic and multifaceted, with clearly defined development trends.

Looking beyond the home market, leading Russian MPs are actively expanding their overseas operations,

covering CIS countries (Armenia, Kazakhstan, Belarus, Kyrgyzstan, and others), several Asian nations (China,

Türkiye), the Middle East (Israel, UAE), and Europe (Serbia, Slovakia, Germany, among others), while the

share of international sales in the total GMV of Russian MPs continues to grow.

As for domestic priorities, the following growth areas may be listed:

- Investments in logistics with a focus on further shortening delivery time by developing dark store networks and air transport,

- improving warehouse efficiency, and reaching out to previously inaccessible regions.

B2B, as many MPs have launched or are actively developing services for business customers. Striving for better quality, with the industry intensifying its fight against counterfeit and substandard goods by tightening regulations

and implementing moderation technologies.

Technological innovations, namely incorporating AI for personalisation, augmented and virtual reality

technologies, and advancing social commerce. Sustainability, with industry initiatives focused on using sustainable

packaging and optimising logistics.

Regulatory environment is expected to evolve further, with the emergence of a comprehensive framework supervising MPs.

A NEW ERA OF E-COMMERCE

As Russian MPs are living through their peak, with infrastructure developing vigorously and market shares strengthening, Wildberries and Ozon have secured nearly 57 % of all online retail and 81 % of e-commerce orders. Their logistics have caught up with international standards, and plans for international exports and large-scale expansion of warehouse networks suggest that we are entering a new era of global e-commerce.

Audacious plans to expand into foreign markets within the EAEU, particularly by Wildberries and Ozon,

are transforming these MPs from local players into prominent contenders in e-commerce. The future of Russian

MPs lies in further technological advancements, enhanced logistics, and the success of global strategies.